Table of Contents

When a loved one passes away, dealing with legal paperwork can be quite overwhelming for you as close family member, especially so if you have just found out you are named as an executor in the Will.

Whether you are a family member, close friend, or listed as a beneficiary, one common question comes up –What happens next?

Processing a Will involves more than just reading the document — it is about applying for the legal right to carry out the deceased’s wishes. This role is usually handled by an executor, but what if the executor is also a beneficiary of the will? Is this allowed in Singapore?

Understanding the steps and legal rights involved would ease your confusion during a difficult time — and help to ensure that everything is managed properly and correctly.

What Does It Mean to Process a Will?

Your loved one has passed away and he owned assets under his name as at the date of his death. How do you access, manage and distribute the deceased’s assets after his death?

Processing a Will in Singapore marks the start of legally administering the estate of someone who has passed away. This usually begins with the named executor applying to the Court for a Grant of Probate— which is a court order that gives the named executor the authority to access, manage and distribute the deceased’s assets according to the Will.

If there is a will but the named executor is unable or unwilling to take up the role of an executor, the intended administrator who wishes to take over the role of the executor would need to apply to the Court for Letters of Administration with Will Annexed. Different procedural rules apply in the court application, but the deceased’s estate will still be distributed to the beneficiaries in accordance with the deceased’s will.

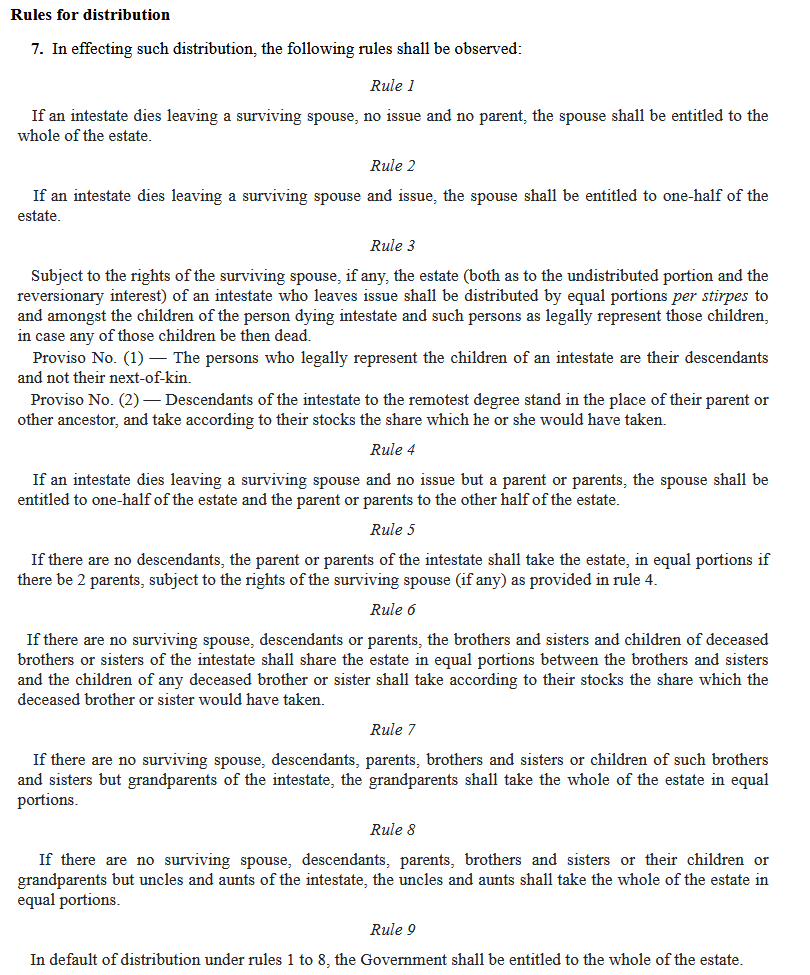

If the deceased did not leave a will prior to his passing, an immediate family member who is willing to take up the role as an administrator may apply to the Court for Letters of Administration. In such event, the deceased’s estate will be distributed to the next-of-kins and family members in proportions as per inheritance laws (as listed in Section 7 of the Intestate Succession Act 1967) or as per inheritance certificate if deceased was a Muslim.

The probate process is governed by the Probate and Administration Act 1934 and overseen by the Family Justice Courts.

Common Scenarios Where This Issue Arises

It’s surprisingly common for people to find themselves in charge of handling a will—sometimes without realising what the role involves. Here are everyday situations where questions about will execution arise:

| Scenario | What Typically Happens |

| You are named both as a beneficiary and an executor | You are unsure if there could be problems arising in managing, as well as being a beneficiary of the estate. |

| The will named an executor who resides overseas | There is confusion around legal requirements or delays in administration. |

| No executor was named in the will | Which family member is suitable to step forward to apply for Letters of Administration. |

| Disputes arise between family members | The decisions of the executor may be challenged by family members, causing delays in the distribution of estate. |

| There are debts left by the deceased or unclear instructions in the will as to how the debts are to be settled. | The executor must navigate financial liabilities before distributing the estate. |

Legal Steps to Process a Will in Singapore

Here’s a general overview of how to process a Will when someone has passed away:

Locate the Original Will

The original will (not a copy) must be submitted. This is often kept in the last place of residence of the deceased, the named executor or a trusted family member. Sometimes the original Will may have been safe kept with the lawyer who attended to the preparation of the Will. Rarely but possibly, the original will could have been placed in a bank safe deposit box. One should refrain from placing an original will in a bank safe deposit box because of difficulty of retrieving it in the event the deceased has passed away.

Apply for the Grant of Probate

The named executor applies to the Family Justice Courts to obtain legal authority to administer the estate. This process includes filing several court documents, submission of the original will, certified true copy of the death certificate and listing the assets of the deceased in a schedule.

Identify and Secure the Estate

The executor is required to identify, list and safeguard the deceased’s assets — such as properties, bank accounts, CPF, share investments — before the distribution starts.

Pay Off Debts and Taxes

Any outstanding liabilities (e.g., income tax, bank housing loans, credit card debts) must be settled before distributions begin.

Distribute Assets According to the Will

Once debts are cleared, the executor distributes the estate to the beneficiaries in the proportions and manner as per the instructions in the will.

If no executor is willing or able to perform the role of an executor, a beneficiary may apply to the Court for Letters of Administration with Will Annexed and to step in as an administrator.

Can a Beneficiary Be the Executor of a Will in Singapore?

Yes—a beneficiary can absolutely be the executor of a Will in Singapore. In fact, this is very common. The law does not prohibit beneficiaries from acting as executors, as long as they are legally capable (i.e., over 21 years old and of sound mind) and not undischarged bankrupts.

Singapore courts recognise that the person best suited to carry out the deceased’s wishes is often someone close—who may also stand to benefit. The key responsibility is to act in good faith and avoid conflicts of interest, especially if disputes arise.

If there are genuine concerns about apparent lack of fairness or competence of the executor, the beneficiaries or other concerned parties with legal rights, may contest the appointment of the executor in Court.

Why Early Legal Guidance Helps

Family members often delay probate applications due to prolonged grief, family tensions, or innocently presuming the will “speaks for itself”.

However, acting early can save being stressed at a later stage due to:

- Deceased’s assets may be frozen until a court’s grant is obtained—causing cash flow issues to dependants.

- Delays in application could cause complications when access to bank accounts is blocked or you need to urgently sell deceased’s property to pay off outstanding mortgage instalments.

Getting experienced legal help early would ensure that the correct documents are filed in time and avoid costly mistakes.

Getting timely legal advice from a lawyer does not mean you are rushing the process or being insensitive to your family members — it is about obtaining clarity of the situation, respecting the wishes of the deceased, and protecting your family members’ interests.

How Pui Khim Can Help with Probate & Wills

At Gateway Law, Pui Khim regularly assists clients in advising on the will and probate application process—whether you are a first-time executor or you are facing a family dispute over inheritance.

Her approach is clear, supportive, and solutions oriented. Whether you need help applying for a Grant of Probate, understanding your duties, or managing expectations among beneficiaries, Pui Khim can guide you with care and confidence.

Clients value her calm communication, legal precision, and ability to resolve complex estate matters efficiently. If you are unsure about your next steps, do consider approaching Pui Khim’s team here at Gateway Law – we are here to hold your hand and guide you through every stage.

FAQs – Processing a Will After Death in Singapore

How long does it take to process a will in Singapore?

For straightforward cases, it typically takes about 2 months to obtain a Grant of Probate, assuming there are no ambiguities, disputes or missing documents. Complex estates or disputed estate applications may take longer.

Can I be both executor and beneficiary of the will?

Yes. This is allowed under Singapore law and is very common. The executor has a duty to act in good faith in his role and follow the terms of the will.

What if the will has not named an executor?

A beneficiary or family member can apply for Letters of Administration with Will Annexed to take over the role of managing the estate.

Is a Probate always required?

Yes, if there are assets to be distribute under a will, obtaining a Probate is usually necessary, save for a few exceptions.

If the bank account has small balance (less than $5,000), you may not need to apply for Grant of Letters of Administration or Probate. You can try approaching the bank directly with supporting documents as the deceased’s next-of-kin to claim the funds.

Jointly held bank accounts do not require a Probate as the banks usually release the funds to the surviving account holder.

For CPF moneys, it is not required to obtain a Probate as it is distributed to the named nominees. If no CPF nominations have been made by the deceased, the Public Trustee’s Office distributes the CPF moneys to beneficiaries according to intestacy laws.

How can Lawyer Ng Pui Khim help with the probate process?

Pui Khim can assist you by filing of probate applications to the Court, advising you of your executor duties, guiding you on the supporting documents required for submission and answering your queries relating to estate distribution. With experienced legal help from her, you will be guided throughout the probate process, and you can avoid delays and unnecessary stress.

PKNG is helmed by Ng Pui Khim. An experienced divorce & family lawyer in Singapore, Pui Khim is practicing as a director under Gateway Law Corporation.

All rights reserved. Any information of a legal nature in this website is given in good faith and has been derived from resources believed to be reliable and accurate. The author of the information contained herein this website does not give any warranty or accept any responsibility arising in any way, including by reason of negligence for any errors or omissions herein. Readers should seek independent legal advice